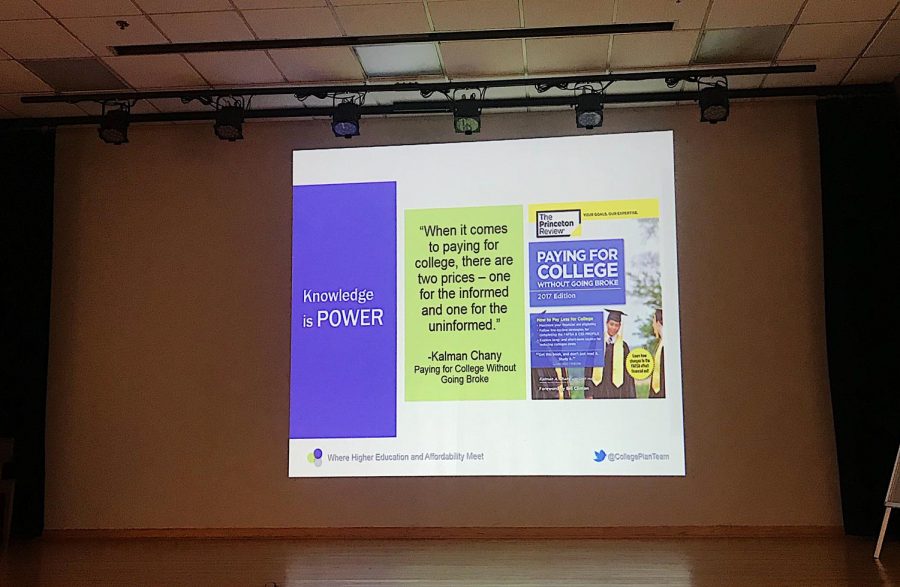

“Paying for College Without Going Broke” Presented by My College Planning Team

Opening slide of the presentation

Mar 22, 2019

The Morton Grove Public Library worked in conjunction with My College Planning Team to present, “How to Pay for College Without Going Broke,” on Thurs., Mar. 21. The 90-minute workshop, presented by certified financial planner/college funding consultant Jim Kraiss, covered strategies, and tips for planning, saving, and paying for college.

My College Planning Team is neither a for-profit or nonprofit entity, but a team of academic and financial advisers from both sectors who work together to reduce college costs and increase financial aid for families all across the economic spectrum. Included in their workshop on Thursday was a 60-minute presentation, later opened up for questions and a group discussion, as well as a folder with additional information and the opportunity for a complimentary private consultation with one of their advisers.

Parents and students from different grades and schools were in attendance for the workshop, which went on from 7:00 to 8:30 pm. Among the students was Niles West senior, Kivaun Jahad, who is hands deep in the college process.

“I attended the workshop because I wanted to get a better perspective on how to pay for college,” Jahad said.

“On the financial side, we want you to look as worse as you possibly can — legally. Yet on the academic side, we want you to look great, the best you can be. So there are two sides to how you appear to colleges, the good and the bad,” Kraiss said.

Many parents and students found the information covered in the presentation to be very helpful. Among them was Virginia Kehren, whose son is a sophomore at Luther Prep in Watertown, Wisconsin.

“I found it helpful as far as what money resources will count against him, how much money some colleges will give us, and also the key point of how to involve students with the process as early as possible so that they’re less likely to be in the percentage of students who transfer after the first year and doesn’t even return,” Kehren said.

Whether you’re a freshman, sophomore, junior or senior, it’s never too early to start thinking about the college process. Take advantage of workshops and opportunities in your community to get in on all the tips and strategies of paying and applying for college.